If you are looking to retire in Portugal after Brexit, you may be eligible for a very attractive tax regime.

As indicated by EY's Attractiveness Survey, Portugal is rated as one of the most appealing countries in Europe, and the 3rd most secure nation in the Global Peace Index.

Portugal solidifies its prestige in the worldwide market, providing a safe investment environment to international investors from all parts of the world.

With the uncertainty of Brexit, it is hard to tell how the Non-Habitual Resident system in Portugal may change for British residents, but those who are thinking about moving to Portugal may wish to consider doing as such before Brexit comes into effect.

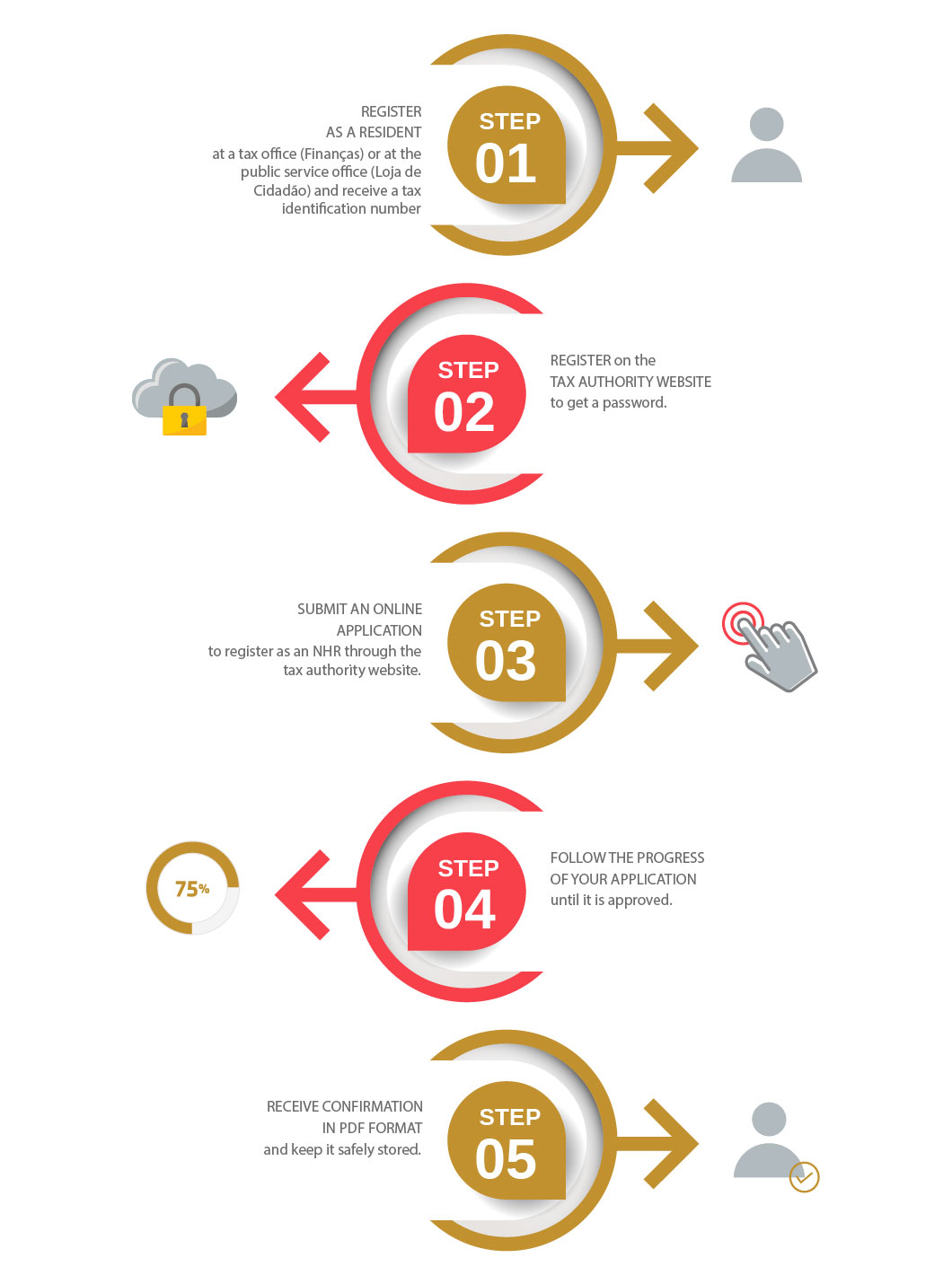

To be recognized as a Non-Habitual Resident, it is necessary to complete an application process with multiple stages. Here at Portugal Homes, we have an experienced team that will provide you with high-quality advice to be conceded the Portugal NHR status, and assist you in all steps in the process of applying to Portugal's Non-Habitual Resident tax regime.

What are the advantages of Portugal NHR?

Portugal NHR status provides tax advantages to those who establish their residence for tax purposes in the country, enabling them to have tax breaks for 10 consecutive years.

Are you coming to work?

You will profit from a 20% fixed income tax (IRS) if you come to Portugal for work. This decreased rate refers to all high-value-added skilled professionals. The professions list is vast and includes jobs such as architects, doctors, tax consultants, senior managers, educators, and designers.

Thinking about retiring abroad?

You can also profit from NHR status if you are a pensioner and are moving to Portugal. All pension incomes from outside Portugal are exempt from IRS payments but earned in Portugal. This is because where double tax agreements exist (such as with Portugal and France for instance), the right to raise taxes falls into the country of residence. Portugal currently exempts retirees from paying taxes on their non-Portuguese pension incomes.

If you’re looking for a nice place to live or spend your stay in Portugal, we can also help you find a house or property > here.

Why Portugal Non-Habitual Resident status is the best option for you?

Other than being exempt from personal income tax on specific types of qualifying income, there are other multiple benefits when applying for Portugal's NHR Status. With the residency certificate you can:

- import a car, without having to pay the current tax;

- register for discounted healthcare through the Portuguese national health service (SNS);

- right to vote in local and EU elections;

- you get to live in one of the most peaceful countries in the world and the Best European Destination since 2015.

Know more about European Union Countries’ Square Metre Prices

Below we have a map featuring current European Union countries and their price per square per meter as of 2018.

Source: Europe's Square Metre Prices

Step-by-step on what you have to do to apply for the Portugal NHR

Note: in order for your Portugal NHR status application to be accepted, it must be requested by March 31st of the year. Contact our After Sales department for more information about this process > here.

Set the basis for your next years. We're here to help.

There are currently 49.000 British citizens residing in Portugal and this number has been growing slowly due to Brexit concerns; many of them are trying to beat the rush to moving to Portugal after Brexit! The good news are that Turismo de Portugal has established a "Brelcome" plan for british citizens who want to move to Portugal. Those who decide to come to Portugal after Brexit will benefit visa-free travel, dedicated airport corridors, health insurance and recognition of their driving license.

As mentioned above, those who wish to retire in Portugal, can do so through the Portugal NHR programme, as it might be your best option thanks to the several tax benefits you are able to take advantage of.

In case you're looking for a new place to live in when you move to Portugal, we can also help you find a house or property here.

Have questions about the NHR Tax Regime? See Frequently Asked Questions here.